michigan.gov property tax estimator

Office of the Auditor General. You can now access estimates on property taxes by local unit and school district using 2020 millage rates.

Wayland Union School Waylandunion Twitter

The Great Lakes State has made a number of changes to.

. After two months 5 of the unpaid tax amount is assessed each month. Worksheet 2 Tier 3 Michigan Standard Deduction Estimator. Closed Friday - Sunday City of Wyoming team members are dedicated to creating an attractive comfortable and engaged.

Ad Our Property Tax Records Finder Locates Local Records Fast. Michigan Property Tax Calculator - SmartAsset Calculate how much youll pay in property taxes on your home given your location and assessed home value. Please enable JavaScript to continue using this application.

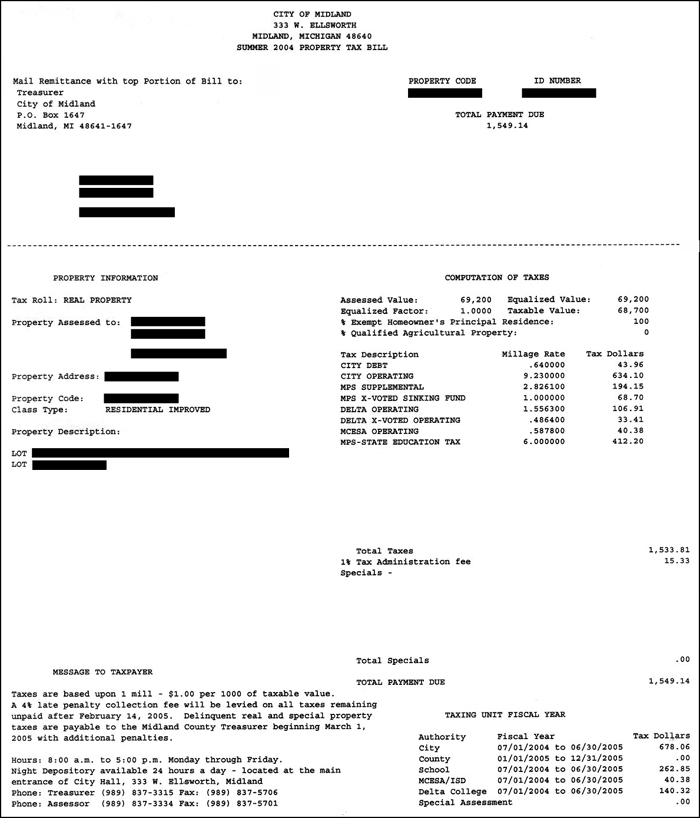

INTEREST Interest is calculated by multiplying the unpaid tax owed by the current interest rate. This system contains US. Property owners can calculate their tax bill by multiplying their taxable value by the millage rate.

State of Michigan Property Tax Estimator. Use this estimator tool to determine your summer winter and yearly tax rates and amounts. Want to calculate your estimated property taxes.

The information you provide is anonymous and will only be used for purposes of this. This estimator provides an unofficial estimate and has no legal bearing on any future tax liability. The mathematical equation below illustrates how this is figured.

145 average effective rate. PENALTY Penalty is 5 of the total unpaid tax due for the first two months. Novitke Municipal Center 20025 Mack Plaza Grosse Pointe Woods MI 48236.

Credit for Income Tax Imposed by Government. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email. Property Tax collapsed link.

Tax Estimator Tax Estimator You can now calculate an estimate of your property taxes using the current tax rates. 313 343-2435 Water Billing Questions. Office of Inspector General.

The State Education Tax Act SET requires that property be assessed at 6 mills as part of summer property tax. Interactive estimators are made available to you as self-help tools for your independent use. City of Wyoming Michigan 1155 28th St SW Wyoming MI 49509 616-530-7226 Fax 616-530-7200 Hours of Operation.

For example if the citys millage rate is 10 mills property taxes on a home with a taxable value of 50000 would be 500. Get In-Depth Michigan Property Tax Reports In Seconds. The maximum late penalty is equal to 25.

Enter the Taxable Value of your property and select the school district from the options provided. Compare your rate to the Michigan and US. Simply enter the SEV for future owners or the Taxable Value for current owners and select your county from the drop down list provided.

You will then be prompted to select. The median property tax in Michigan is 214500 per year for a home worth the median value of 13220000. You can now access estimates on property taxes by local unit and school district using 2020 millage rates.

Worksheets 4 Recipients of FIPMDHHS 5 Renters Age 65 Estimator. Michigan State Tax Quick Facts. Reports and Legal Individual Income Tax New Developments for Tax Year 2021 Income Tax Self-Service New Developments for Tax Year 2021 Income Tax Self-Service.

Follow this link for information regarding the collection of SET. Monday - Thursday 700 AM. 313 343-2785 Tax Questions.

100 per each 100000 in. Simply enter the SEV for future owners or the Taxable Value for current owners and select your county from the drop down list provided. Information for 2021 Retirement and Pension.

Counties in Michigan collect an average of 162 of a propertys assesed fair market value as property tax per year. State of Michigan Property Tax Estimator. Michigan is ranked number eighteen out of the fifty states in.

You will then be prompted to select. 2630 cents per gallon of regular gasoline and diesel. By accessing and using this computer system you are consenting to system monitoring for law enforcement and other purposesUnauthorized use of or access to this computer system may subject you to state.

Resulting Property Tax Estimate Special Notes.

Calculation Of An Individual Tax Bill A Michigan School Money Primer Mackinac Center

2022 Property Taxes By State Report Propertyshark

Taxes Pittsfield Charter Township Mi Official Website

How Mi Property Taxes Are Calculated And Why Your Bills Are Rising

Prorating Real Estate Taxes In Michigan

Sterling Heights Po So 1487000 Ads Businessdirectory Macombdaily Com

Township Tax Shelters Georgetown Public Policy Review

New York Property Tax Calculator Smartasset

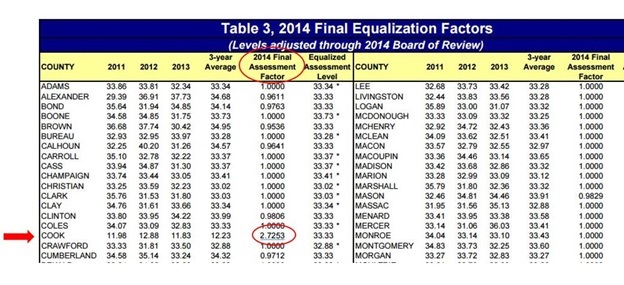

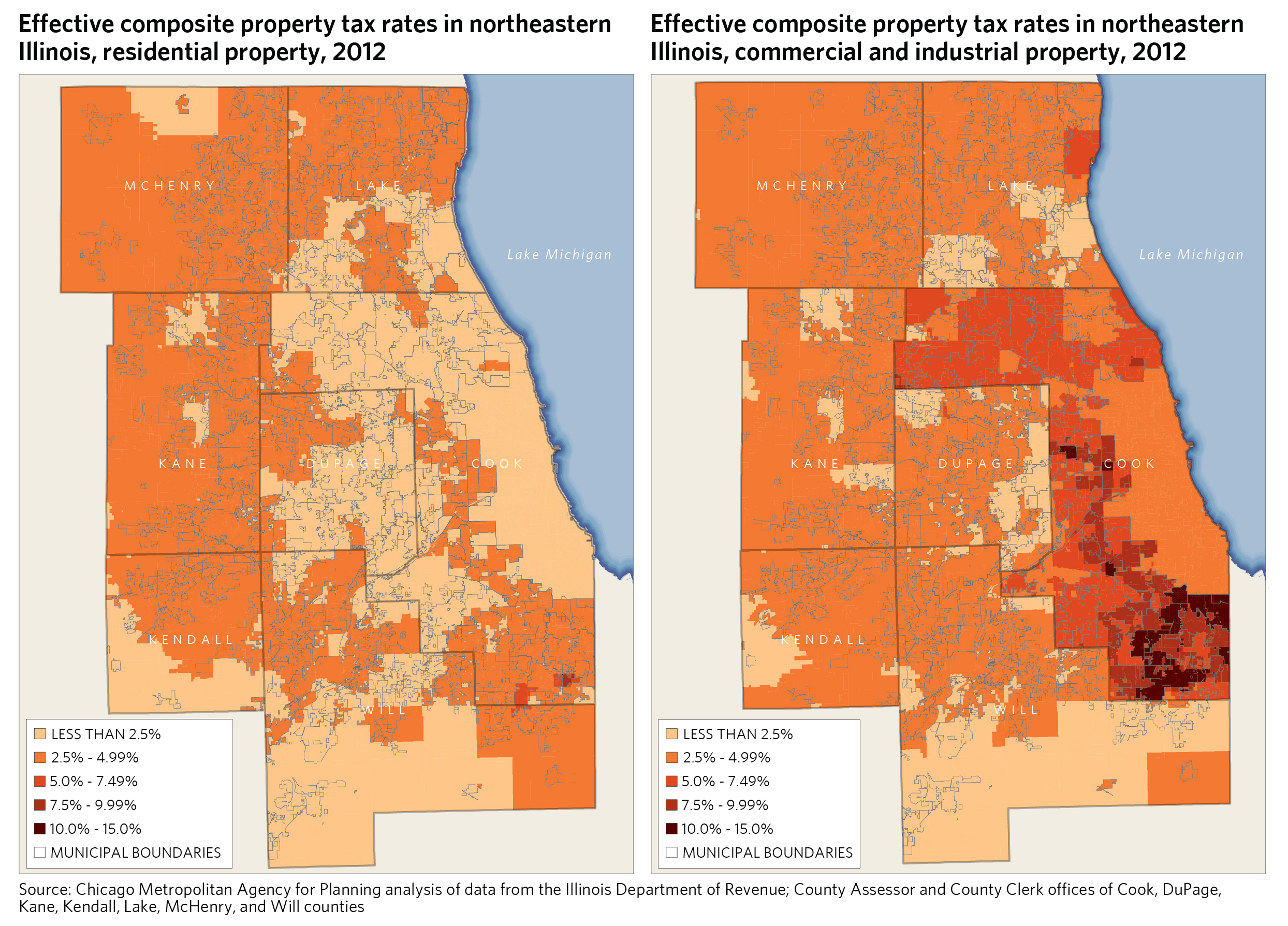

Calculate Your Community S Effective Property Tax Rate The Civic Federation

Michigan Department Of Treasury Taxes

Treasurer S Office Pittsfield Charter Township Mi Official Website

Michigan Department Of Treasury Taxes

Cook County Property Tax Classification Effects On Property Tax Burden Cmap

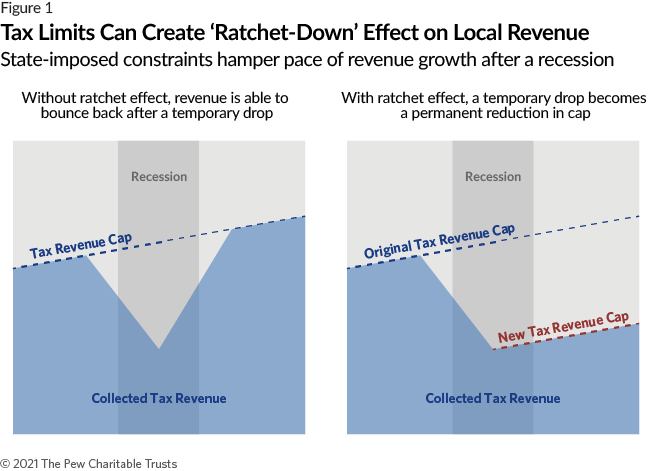

Local Tax Limitations Can Hamper Fiscal Stability Of Cities And Counties The Pew Charitable Trusts

Where S My Refund Michigan H R Block